Market Research

Market Research helps companies understand and analyze their customers. Market research mostly focuses on the following four types of information:

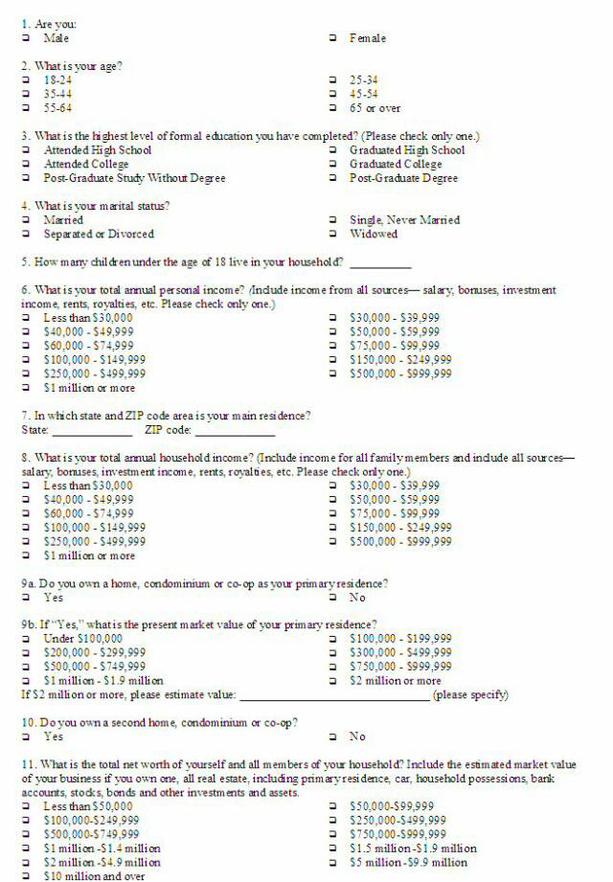

- Demographic characteristics. Research in consumer markets would include the age, race, sex, education, marital status, housing, income, and number of children. Research in business markets would include the type of industry, annual sales, number of employees and locations, and years in business.

- Buying behaviors. Research is done to see how customers buy products such as in a retail store or online. Also, the frequency of purchases and the type of advertising or influence that motivated them to buy.

- Lifestyle or psychographics. Research on the type of hobbies, sports, and vacations, TV shows, magazines, religion, frequency of fine dining, frequency of fast food, and even personality traits and sexual orientation.

- Customer Satisfaction. Research through surveys on the perceived value for the price, ease of use, useful features, what they would like to see in the future, and whether they are likely to purchase more product.

Most often, it is the larger companies who invest in market research. Small companies feel they already know their customer base pretty well. Companies that sell commodity products such as gold, coal, grain, oil, rice and paper do not really need much market research as these products have characteristics that are indistinguishable across the companies that sell it. With commodities, customers are mostly concerned about low prices and fast service. Companies, like a phone manufacturer that only sells to one type of customer, is considered to be in a homogenous market. These customers share most characteristics. However, with a focus on product differentiation, companies can emphasize the quality of their products such as, “their coal burns longer,” or “their phones sound better,” than that of their competitors.

There are basically two types of market research; primary market research, which involves asking questions through a survey, an observational approach, or experimental approach, and secondary market research, which involves checking articles in newspapers, magazines, and books. Good secondary sources to help research your industry are: www.census.gov/eos/www/naics/, www.hoovers.com/free/, and www.standardandpoors.com.

Secondary research is less expensive and quickest to perform, however, you get much more detail with a primary market research customer survey. For example, with primary research you can get a good feel from prospects on the value of a potential product release, and whether or not they would buy it. It can then be narrowed down to the type of prospect who would buy the product based on items such as age, location, and gender.

It is important to make sure the primary research survey questionnaire gives you the exact data you need or else you will be wasting everyone’s time. By following these 7 steps, you should have all areas covered:

- What are the goals of the survey? Think about exactly what it is you want to understand from your customers.

- Who will you survey? You want to make sure you are surveying the right clientele. For example, if your company has two distinct areas with two distinct customers, you would not want to survey the wrong customers on a particular product release. You also might just want to ask a sample of your customer base to get an approximate value.

- How will you perform the survey? Will this be done via a web site, through an e-mail blast, over the phone, or in person? Also, will you or someone within the company perform these surveys, or will you get an unobjectionable outside source? People tend to be more honest with an outside source rather than someone within your company. There are pros and cons to all of these methods. For example, an e-mail blast is quick and easy, but people tend to ignore them or might be too dissatisfied to even want to participate. The telephone requires more time and effort, and sometimes people hate answering these types of calls, however, you can get a personal verbal response. You need to determine what method your customers are most willing to participate in, and if the costs outweigh the benefits.

- Create the questionnaire. Be sure to brainstorm with people within your organization to create the most effective and pertinent questions. Keep the survey as short as possible and test it out before you give it to your customers. The questions can be developed with a quantitative or qualitative response:

-

- Quantitative information involves questions that have a numerical answer, which can then give you a percentage base. For example, you can have a question that has an answer of “yes” or “no” which you can then express data like, “76% of all females are likely to buy the product.” These are considered closed-ended questions, which are easy to compile and compare. Ratings such as 1 – 5 or excellent, good, average, poor, and very poor are great to use for customer satisfaction surveys. You should be concerned with a rating of 3 or average as in most cases, it is a customer who is truly dissatisfied, however, does not want to come off too cruel. Poor and very poor are obviously big alarms that need immediate attention.

-

- Qualitative information involves a verbal statement which can be used to study suggestions or comments, not just “yes” or “no” type of answers. These are considered open-ended questions that truly capture the customer’s attitude and opinion. You should allow at least one open-ended question on the customer satisfaction survey.

- Present the survey. If you followed steps 1 through 4 properly, getting the survey out to the customers should be straightforward. Make sure you have up-to-date contact information. If you run into snags, just make the necessary adjustments and carry on until your targeted numbers of surveys are completed.

- Analyze the data. This is the anxious part of the project. Be careful not to analyze the surveys until all of the data is compiled, or else you might get a false sense of success or failure. Your heart wants a desired outcome and you might tend to analyze the data in an unobjective way. Be as objective as possible and look for trends, both positive and negative. This is an important aspect of being a strong manager and leader. This goes for any type of survey including customer satisfaction. There might be some surveys that are questionable that need attention, however, do not pertain to the questions asked. For example, you might want to know if a product is easy to use, however, the customer is upset at a salesperson for not returning a call and thus gives all “very poor” answers or a vulgar opinion. Make sure you keep the data in simple terms so that everyone can fully understand the results and what actions need to be taken. Report on the most important and major findings, and do not clutter the data with too much unimportant statistical analysis.

- Act on the results. The most important aspect of the completed survey is what you do with the information given. Decide on the recommendations or evaluations and then determine what action needs to be taken. If, for example, improvements need to be made, address those issues immediately and after a period of a few months, send out a follow up survey with the pertinent questions to be sure all has been corrected. If the research was done to support a decision on a new product release, immediately start the process on determining the production, cost, and release dates.

-